What to Do If You Were Overcharged VAT on an AliExpress Package in the UK

Shopping on AliExpress has become increasingly popular among UK residents seeking affordable products from overseas. However, since the introduction of new post-Brexit VAT rules, many shoppers have faced confusion and frustration regarding VAT charges on AliExpress orders. If you’ve recently received a package and suspect that you were overcharged VAT, you are not alone. Understanding how VAT is applied and what steps to take if you’ve paid too much is crucial for UK shoppers who want to avoid unnecessary costs.

The issue of overcharged VAT is particularly relevant as UK customs regulations have changed, and online platforms like AliExpress are now required to collect VAT upfront on orders under £135. Despite these changes, errors can occur, leading to double charges or incorrect fees at the point of delivery. Knowing your rights and the correct process for claiming a VAT refund can help you resolve these issues quickly and ensure you only pay what you owe.

Think you’ve paid too much VAT on your AliExpress order? Before you sort it out, treat yourself to a little win—explore this month’s codes for UK shoppers and see how much you could save next time.

What to Do If You Were Overcharged VAT on an AliExpress Package in the UK

Does AliExpress Charge VAT on UK Orders?

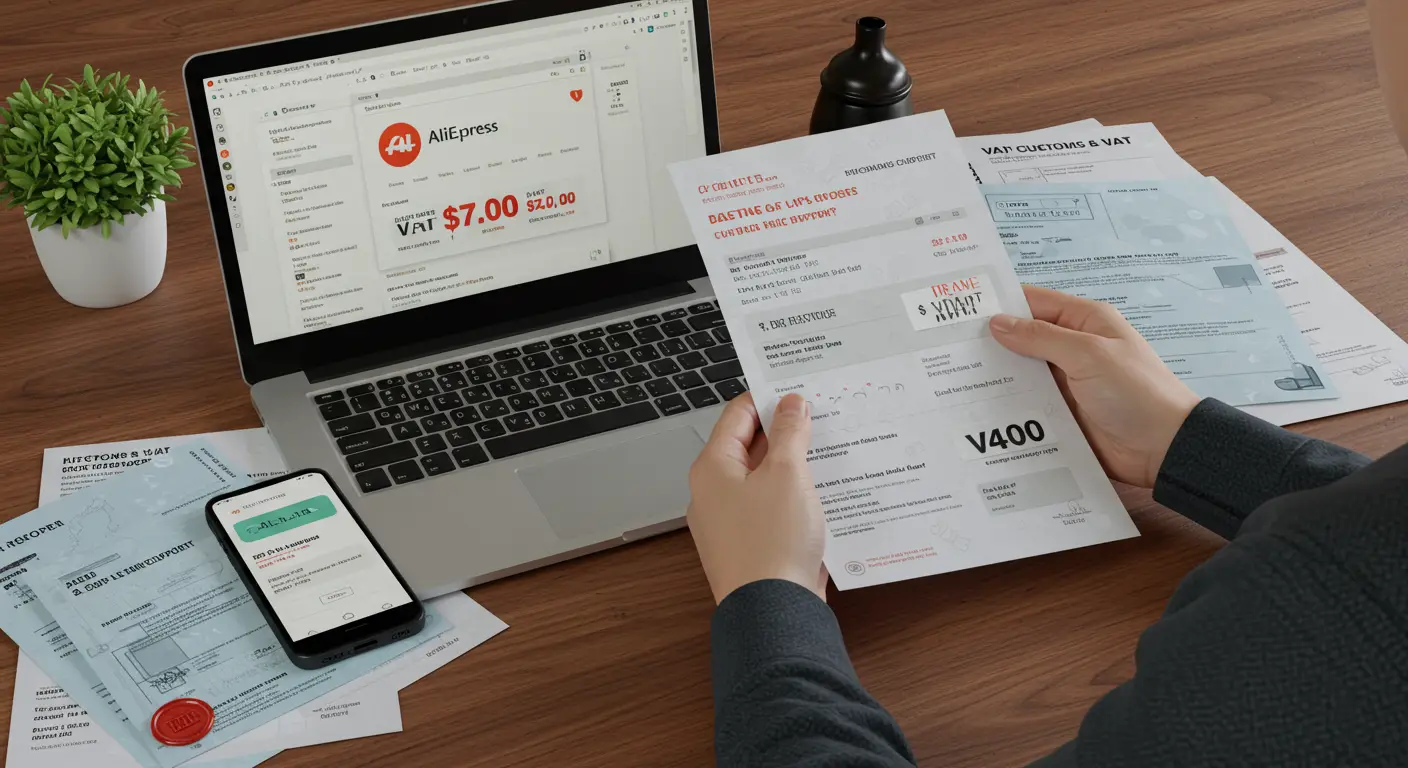

AliExpress does charge VAT (Value Added Tax) on orders shipped to the UK. Since 1 January 2021, following Brexit, all goods imported into the UK from overseas, including those purchased on AliExpress, are subject to UK VAT. For orders under £135, AliExpress automatically collects VAT at checkout and remits it to HMRC. For orders above £135, VAT is usually collected by the courier or Royal Mail before delivery.

- Orders under £135: VAT is included in the price you pay at checkout on AliExpress. You should not be charged VAT again by UK customs or the delivery company.

- Orders over £135: VAT is not collected at checkout. Instead, you pay VAT (and possibly customs duty) to the courier before receiving your package.

AliExpress show prices with tax included for UK buyers, but always double-check your order summary to confirm. If you are unsure, use an AliExpress tax calculator to estimate the total cost.

Do You Pay VAT on Goods from China to the UK?

Yes, VAT applies to all goods imported from China to the UK, regardless of the country of origin. This means that when you buy from AliExpress (which is based in China), you will pay VAT on your purchase. The rate is currently 20%.

If you are charged VAT twice (once at checkout and again on delivery), you may have been overcharged VAT. This is a common concern discussed in Aliexpress customs Reddit and AliExpress tax Reddit forums.

Do I Have to Pay VAT on Goods from the EU to the UK?

Yes, you must pay VAT on goods imported from the EU to the UK. Since Brexit, all goods entering the UK from the EU are treated the same as those from non-EU countries. AliExpress applies VAT at checkout for orders under £135, regardless of whether the seller is based in the EU or elsewhere.

Do You Pay Both VAT and Customs Duty?

VAT and customs duty are separate charges. For most low-value AliExpress purchases (under £135), you only pay VAT. For goods over £135, you may have to pay both VAT and customs duty, depending on the type and value of the goods.

- VAT: 20% on the total value (including shipping and insurance).

- Customs duty: Usually applies to orders over £135, and the rate depends on the product category.

If you see both charges on a single package, check your receipts and the courier’s invoice to ensure you haven’t been charged VAT twice.

What to Do If You Were Overcharged VAT on AliExpress

If you believe you were overcharged VAT on an AliExpress package—for example, if you paid VAT at checkout and were asked to pay again by the courier or Royal Mail—take the following steps:

-

Gather Evidence

Keep all relevant documentation, including:- AliExpress order confirmation showing VAT paid at checkout

- Payment receipts

- Courier or Royal Mail invoice demanding VAT payment

- Photos of package labels showing customs declarations

-

Contact the Courier or Royal Mail

If you were asked to pay VAT on delivery, contact the courier’s customer service. Explain that VAT was already paid at checkout and provide your AliExpress invoice as proof. -

Request a Refund from HMRC

If the courier cannot resolve the issue, you can apply for a VAT refund from HMRC. Use the C285 form (VAT refund application) and submit your supporting documents. -

Contact AliExpress Customer Service

Open a dispute on AliExpress. Explain the situation, attach evidence, and request assistance. AliExpress may provide a partial refund or guide you on further steps.

Tip: Many UK buyers on Aliexpress customs Reddit have successfully reclaimed VAT by providing clear evidence and following up persistently.

Can You Reclaim VAT on Customs Duty?

You cannot reclaim VAT on customs duty itself, but you can reclaim VAT that was double-charged on the value of your goods. Customs duty is a separate charge and is not refundable unless there was an error in calculation or you returned the goods.

If you paid both VAT and customs duty, check if the VAT was calculated correctly. If you believe you were overcharged, follow the refund process outlined above.

Can I Claim VAT Back from AliExpress?

AliExpress does not directly refund VAT once it has been remitted to HMRC. However, if you were charged VAT twice, you can open a dispute on AliExpress for a partial refund. In most cases, you will need to reclaim the overcharged VAT from HMRC or the courier.

AliExpress buyer protection may help if you can prove you were overcharged. Attach all evidence to your dispute for the best chance of success.

AliExpress Tax-Free Shopping: Is It Possible?

AliExpress tax free shopping is not available for UK buyers. All imports are subject to UK VAT regulations. Any site or seller advertising “tax free” AliExpress shopping for the UK is likely misleading or not compliant with UK law.

Some buyers look for ways on how to avoid AliExpress tax UK, but attempting to bypass VAT is illegal and can result in fines or confiscated goods.

AliExpress Promo Code and VAT

AliExpress promo codes can reduce the total price of your order, but VAT is calculated on the final amount paid after applying the discount. Promo codes do not exempt you from VAT or customs duties.

- Example: If your order totals £100, and you use a £10 promo code, VAT is calculated on £90.

AliExpress Tax Calculator for UK Buyers

To estimate your total cost, including VAT and possible customs duty, use an AliExpress tax calculator designed for UK shoppers. These calculators help you budget for:

- Product price

- Shipping and insurance

- VAT (20%)

- Customs duty (if applicable)

- Courier handling fees

AliExpress show prices with tax for UK buyers, but always verify before checkout. If in doubt, check the seller’s description or contact them directly.

AliExpress Import Tax: UK vs. USA

Some buyers search for AliExpress import tax USA to compare with the UK. In the UK, VAT is mandatory on all imports, while in the USA, import tax (sales tax and customs duty) depends on the state and the value of the goods.

- UK: VAT applies to all imports, and customs duty applies above £135.

- USA: No federal VAT; import tax varies by state and value, with a higher de minimis threshold ($800).

If you relocate or shop for delivery to the USA, research the specific rules for your state.

How to Avoid AliExpress Tax in the UK

Legally, you cannot avoid paying VAT on AliExpress orders to the UK. However, you can minimise extra charges and avoid double payment by:

- Ensuring VAT is included at checkout for orders under £135

- Buying from sellers who use AliExpress Standard Shipping (often smoother customs processing)

- Keeping all receipts and order summaries

- Refusing to pay VAT again on delivery if you have already paid at checkout—contact the courier with proof

Do not ask sellers to mark your goods as “gifts” or under-declare the value. This is illegal and can result in confiscation or penalties.

AliExpress Customs and Tax: Community Insights

Many UK buyers discuss their experiences on Aliexpress customs Reddit and AliExpress tax Reddit. Common topics include:

- Double-charged VAT and how to reclaim it

- Delays at customs and how to speed up processing

- Which couriers are more likely to charge extra handling fees

- Tips for successful disputes and refunds

Reading these forums can provide real-world insights and help you avoid common pitfalls when shopping on AliExpress from the UK.

What If AliExpress Shows Prices With Tax, But You’re Still Charged on Delivery?

If AliExpress show prices with tax included but you are asked to pay VAT again on delivery, this is likely an error. Take the following steps:

- Check your AliExpress order summary for a line item labelled “VAT”.

- If VAT was paid at checkout, contact the courier and provide proof.

- If the courier insists, pay to release your package, but keep all documentation.

- Apply for a VAT refund from the courier or HMRC using the evidence.

- Open a dispute with AliExpress if you need additional support.

Tip: Always check for the “VAT included” note on the AliExpress product page and at checkout.

AliExpress Seller Selection and VAT Transparency

Choose reputable sellers who have clear policies regarding VAT and customs. Some things to look for:

- High ratings and positive reviews from UK buyers

- Clear mention of VAT inclusion in the product description

- Responsiveness to questions about VAT and customs

- Use of AliExpress Standard Shipping or reputable couriers

If you are unsure, message the seller before purchasing to confirm that VAT will be collected at checkout and not on delivery.

AliExpress Return Policy and VAT Refunds

If you return an item to the seller, you can request a VAT refund for the returned goods. The process involves:

- Returning the item as per AliExpress return policy

- Obtaining proof of return and refund from AliExpress or the seller

- Applying to HMRC for a VAT refund with supporting documents

Note: Handling fees or customs duty may not be refundable.

Best Practices for UK Shoppers on AliExpress

- Always check if VAT is included at checkout

- Keep all order confirmations and payment receipts

- Use a reliable AliExpress tax calculator to estimate your total costs

- Join Aliexpress customs Reddit and AliExpress tax Reddit for community advice

- If overcharged, contact the courier, AliExpress, and HMRC with evidence

- Use AliExpress promo codes to reduce your upfront cost, but remember VAT is still due on the discounted price

Shopping on AliExpress from the UK requires awareness of VAT and customs rules. By following these steps and understanding your rights, you can avoid overpaying and reclaim any VAT charged in error.

FAQ: What to Do If You Were Overcharged VAT on an AliExpress Package (UK)

How can I tell if I have been overcharged VAT on my AliExpress order?

If you notice that the VAT charged by AliExpress at checkout is different from the amount requested by the courier or Royal Mail upon delivery, you may have been overcharged. Always check your AliExpress order invoice and compare it with the customs or courier receipt. The correct VAT rate for most goods imported into the UK is 20%, but some items may have a reduced or zero rate.Why am I being asked to pay VAT again on delivery when I already paid on AliExpress?

Since July 2021, AliExpress is required to collect UK VAT at the point of sale for orders under £135. Occasionally, mistakes happen, and UK customs or couriers may request VAT again. In such cases, you should provide proof that VAT was already paid to avoid double charges.What documents do I need to claim a VAT refund if I was overcharged?

You will need the following:- Your AliExpress order invoice showing VAT was paid at checkout.

- The customs or courier receipt showing the extra VAT charge.

- Proof of payment for both charges (bank statement or payment confirmation).